Every day, decisions that determine revenue, margin, and customer experience are being made on stale, siloed, or incomplete data. In multi-location enterprises retail, food service, convenience, hospitality, logistics the consequences compound quickly: a promotion runs out of stock in half your stores, a compliance issue is discovered after it spreads, or labor is misallocated because yesterday’s traffic looked “normal.”

Call it what it is: a hidden tax on your business.

Most organizations can’t see it line-by-line, but they feel it in outcomes waste creeping up, service times slipping, loyal customers churning. We call this the $5 million problem because, across hundreds of sites, even small inefficiencies roll up to seven figures fast.

Two weeks from now, we’ll dig into how leaders are eliminating this tax for good. In our October 30 live panel, Krishna B (IT Director at RaceTrac) will share how they moved from fragmented data to real-time operational intelligence at scale. Consider this post your primer on the problem and a preview of where the solution starts.

Fragmentation is the Default but It’s No Longer Sustainable

If you run 50, 500, or 5,000 locations, fragmentation is practically baked in. Each site has its own realities: different hardware vintages, point solutions acquired over years, regional processes, and a patchwork of vendor integrations. Central teams stitch together enterprise data management with nightly jobs and monthly rollups. It “works” until it doesn’t usually when the business needs a timely answer and the data’s not ready.

Why fragmentation persists:

- System sprawl: POS, ERP, WFM, e-commerce, loyalty, delivery marketplaces, sensors/IoT each system solves a local problem but creates a new data silo.

- Batch bias: Historic investments favor end-of-day or end-of-week consolidation, not streaming.

- Ownership gaps: IT, digital, ops, and finance each manage “their” data; no one owns the cross-functional picture.

- Edge variability: Locations operate in environments with unstable connectivity, legacy hardware, and inconsistent data hygiene.

This was survivable when demand patterns were predictable, labor markets were stable, and compliance requirements were lighter. Today, it’s a competitiveness issue.

The Hidden Costs You Don’t See on a P&L But Pay Anyway

Leaders often ask, “Where exactly is fragmentation costing us?” Start here:

- Inventory waste & stockouts

Without trusted, real-time operational intelligence, stores over-order based on last month’s seasonality or under-order during a pop-up surge. In convenience and quick-serve, perishable spoilage and missed add-on sales quietly balloon. - Labor misalignment

Thirty minutes late on a traffic spike translates to longer queues, lower conversion, and overtime later in the week to “catch up.” Even a modest improvement in labor placement by location and hour compound across the fleet. - Compliance penalties & reputation risk

Batch reporting catches problems after the fact. Health & safety, age verification, and loss prevention events need real-time detection and workflow, not next-day retrospectives. - Slow promo & pricing feedback loops

When teams evaluate performance weekly, they burn precious days continuing ineffective offers or fail to double down on what’s working. - Tech debt in your analytics team

Analysts spending 60–70% of their time reconciling data and maintaining pipelines aren’t generating insights. The opportunity cost is enormous.

Back-of-the-napkin lens: If 100 locations waste just $500/week from inventory, labor, and promo inefficiency, that’s $2.6M/year. Scale to 500–800 stores and add compliance or lost loyalty, and the “hidden tax” easily tops $5M.

What Modern Looks Like: From Data Siloes to Operational Intelligence

A multi-location data strategy isn’t a new dashboard it’s an operating model where data powers decisions at the edge and the center simultaneously.

Key characteristics:

- Unified, event-level data foundation: Transactions, telemetry, labor, inventory, and digital signals stream into a single model standardized, deduped, and enriched with location context.

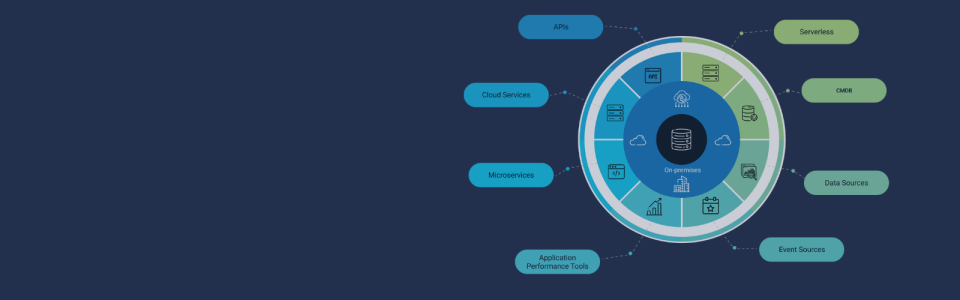

- Edge-to-core architecture: Lightweight connectors publish events from each site; a central platform processes and returns decisions or alerts within seconds.

- Role-based experiences: Store managers don’t need a galaxy of charts; they need two or three prioritized actions per shift. HQ needs drilldowns by region, concept, and cohort.

- Closed-loop workflows: Insights trigger tasks in the systems people already use (WFM, task management, ticketing) and completion data flows back to measure impact.

- Privacy, security, and observability baked in: Enterprise guardrails and lineage by default, so you scale without rework.

This is operational intelligence the layer that turns unified data into timely decisions, ownership, and measurable outcomes.

“Rip and Replace” Is a Myth: A Practical Path to Unified Data

You don’t have to rebuild your stack. The fastest transformations respect what’s already working and layer in real-time connective tissue where it matters most.

A pragmatic roadmap:

- Start with two high-ROI use cases

Pick issues that are visible and frequent e.g., perishables ordering and peak-hour staffing. Define a crisp before/after metric. - Instrument the edge

Stream transactions, inventory changes, and staffing events from a handful of pilot locations. Aim for minutes, not days. Normalize identifiers early. - Create the action loop

Instead of more reports, push prioritized actions to store leaders. Make it impossible to ignore. - Prove the impact in weeks

Compare pilot vs. control on your target metric. Document operational anecdotes (e.g., “shift leads report fewer stockouts on top sellers”). - Scale in rings

Graduate from 10 to 50 to 200+ locations as your data quality and change management stabilize. Add adjacent use cases (promo ops, compliance, loss prevention).

Building the Business Case with ACI Infotech: Speak in Outcomes, Not Infrastructure

Executives rarely fund “data platforms.” They fund margin, growth, and risk reduction. Anchor your case in outcomes your CFO and COO care about.

ROI levers to quantify:

- Waste reduction: Perishable shrink, returns, markdowns.

- Labor efficiency: Productive hours per transaction, queue time, schedule adherence.

- Sales lift: On-shelf availability, attachment rates, localized promos.

- Compliance & loss: Incident detection latency, penalties avoided, shrink decrease.

- Analyst productivity: Hours shifted from pipeline maintenance to decision science.

A simple structure:

- Current state: Out-of-stocks on top 100 SKUs are 7–9%; perishables waste at 3.5%.

- Target state (90 days): Reduce OOS to <4%; waste to <2.5% in pilot.

- Financials: Each 1% OOS improvement on top movers equates to $X in weekly sales; 1% waste reduction saves $Y/month.

- Investment: Streaming connectors + action layer + change management.

- Payback: 3–6 months based on pilot outcomes; then scale.

When you frame your multi-location data strategy around business outcomes, funding and cross-functional alignment follow.

Proof in the Field: What Operators Are Achieving

We’ll go deep on specifics during the live discussion, but here are the kinds of outcomes peers are reporting as they unify data and operationalize decisions:

- 30% reduction in waste by tightening perishables ordering windows with real-time demand cues.

- 15% improvement in labor efficiency by dynamically rebalancing staff during peak micro-windows.

- Faster promo iteration moving from weekly readouts to same-day optimization on price and placement.

- Near-real-time compliance visibility with automated alerts and workflows that stop issues before they cascade.

The Bottom Line

Fragmented operations aren’t a technology problem; they’re a decision-latency problem. The enterprises pulling ahead aren’t necessarily spending more on tools they’re aligning enterprise data management with the moments where value is created or lost, and they’re delivering operational intelligence where it matters: at the edge.

If you’re living with retail data challenges that show up as waste, inconsistent experience, and slow feedback loops, you don’t have to accept the hidden tax. A unified, streaming, action-oriented multi-location data strategy can pay for itself quickly and set you up for sustainable advantage.

Join the Conversation (and Bring Your Questions)

From Fragmented to Unified: How Multi-Location Leaders Turn Data Chaos Into Competitive Advantage

The Future of Real-Time Personalization & Loyalty

Live Panel • October 30, 2025 • 2:00 PM ET • 60 minutes

Hear how operators have already made the leap including Krishna B (IT Director at RaceTrac) will walk away with a blueprint, a business case, and a Monday-morning action plan.

Faqs

It creates decision latency: store, labor, inventory, loyalty, and IoT data live in silos, so teams act on week-old rollups instead of live signals.

BI explains what happened; operational intelligence drives what happens next. It streams events, prioritizes role-based, and closes the loop by tracking completion and impact inside the tools teams already use.

No. Most wins come from layering lightweight streaming connectors and an action/decision layer over POS, WFM, ERP, and loyalty systems you already have.

High-leverage starters: perishables ordering peak-hour staffing, promo/pricing iteration (sales lift), and real-time compliance alerts (risk ↓).

Lead with outcomes, not infrastructure: current state → 90-day target → $ per 1% change → investment → payback. Keep change management and measurement in scope from day one so finance can validate returns.